child care tax credit portal

The use of this site constitutes your agreement to the CNMI Department of Finance Advance Child Care Tax Credit Portal. CNMI Advance Child Tax Credit Update Portal.

Millions Of Families Received Irs Letters About The Child Tax Credit

See Form DTF-215 for recordkeeping suggestions for self-employed persons claiming the earned income credit.

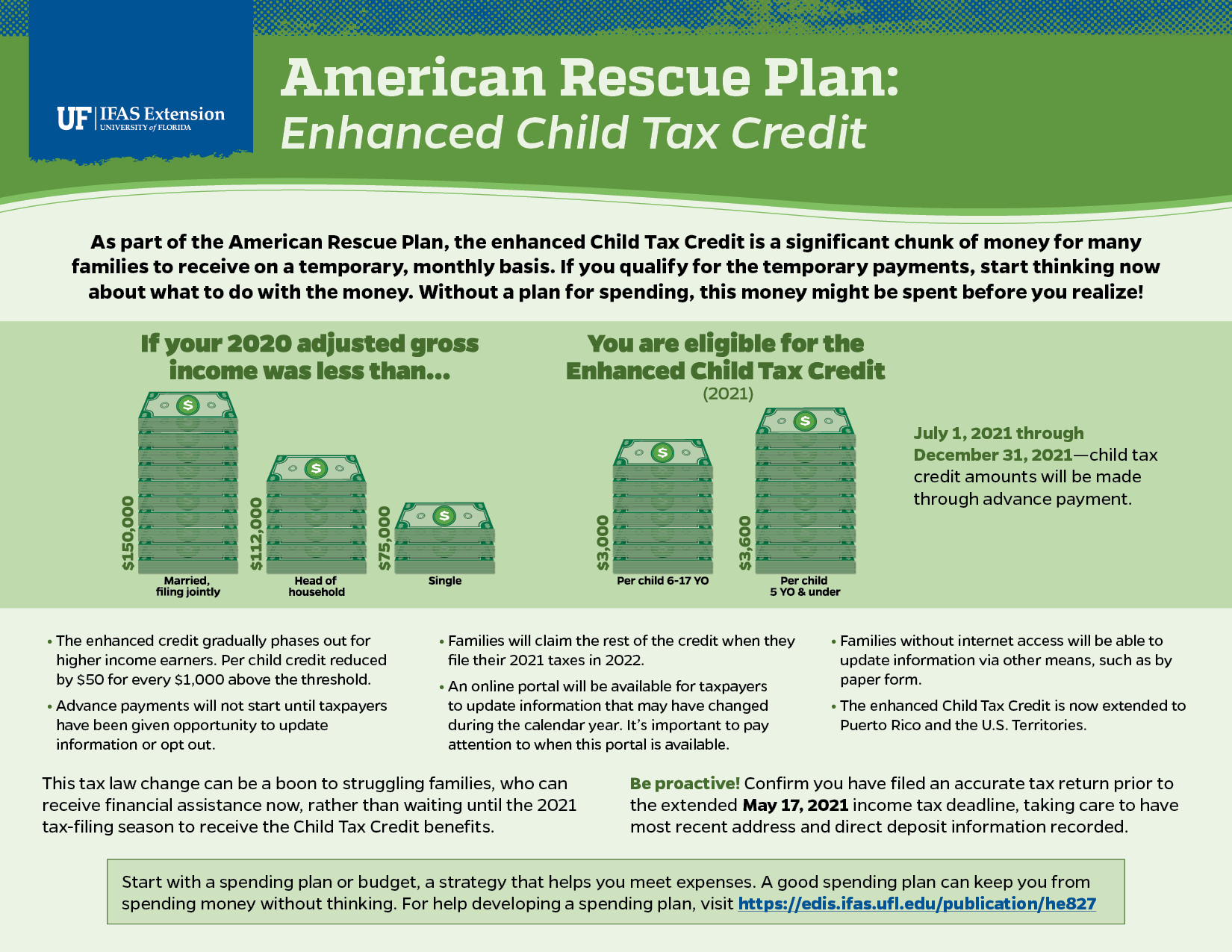

. Information on tax credit programs you may be eligible for such as Earned Income Tax Credits New York State Noncustodial Parent Earned Income Tax Credit Child Tax Credits and Child. Pay money into your account pay your childcare provider apply for a new child Youll need the Government Gateway user ID and. The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are.

Child Tax Credit Connecticut State Department of Revenue Services IMPORTANT INFORMATION - for filers of the following tax types. Parents can claim the benefits for up to three children. If the form you need is not available in your language please call 1-888-208-4485 TTY.

The Employer-Provided Child Care Facilities and Services credit allows businesses to receive a valuable tax credit of 25 of related child care expenses and 10 of their resource and referral. If youve registered for Tax-Free Childcare sign in to. Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021.

Or Up to 8000 for two or more qualifying people who. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. FAMILIES in Connecticut can apply for the states child tax credit and possibly receive up to 250 per child.

Individual Income Tax Attorney Occupational Tax Unified. Please email or mail completed forms to your local child support office. IT-215-I Instructions Claim for Earned Income Credit.

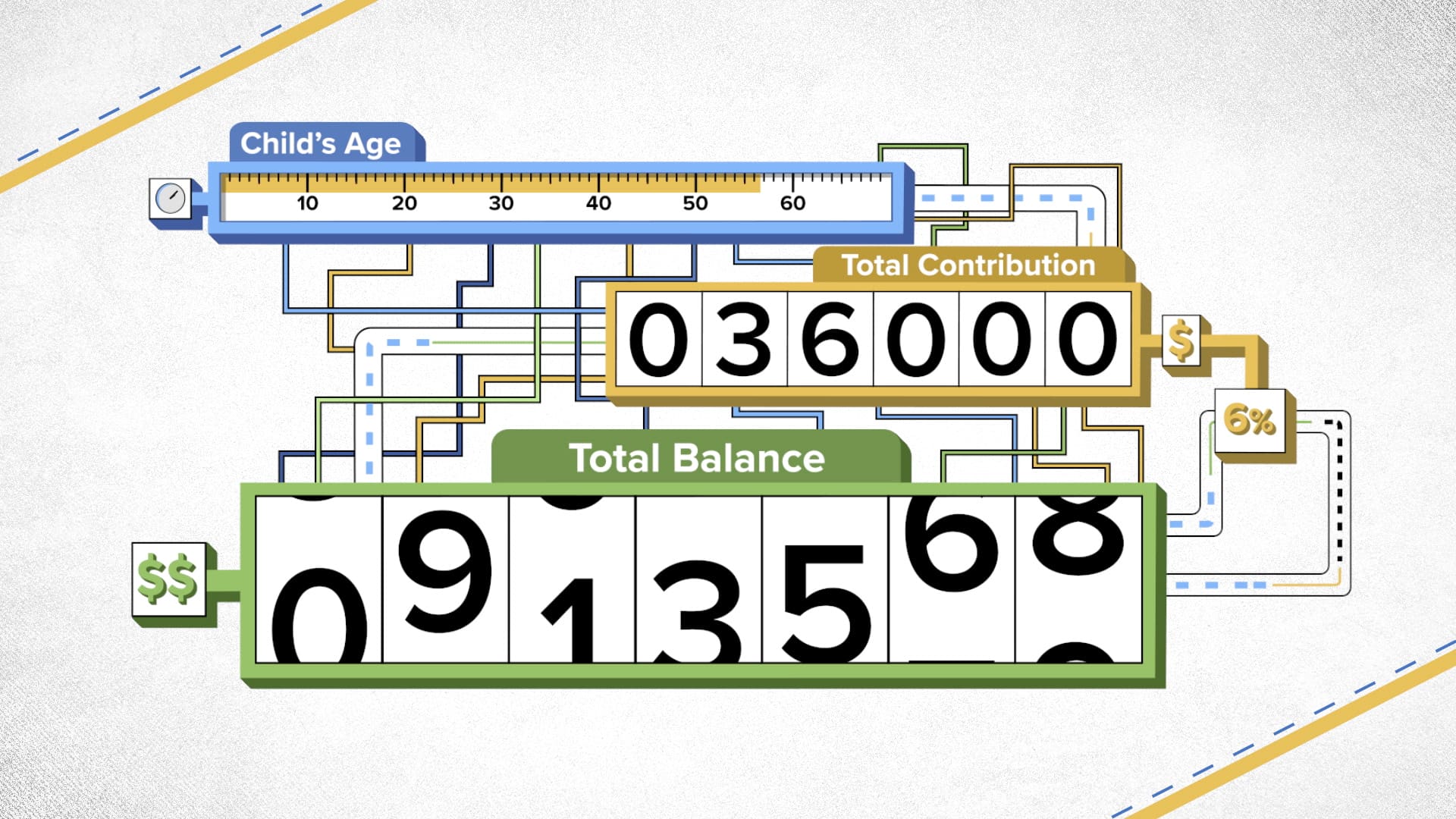

The CCRN is a locally operated non-profit organization whose purpose is to educate and empower childcare providers advocate on behalf of children in our region and work with families to find. The Child Tax Credit provides money to support American families Here is some important information to understand about this years Child Tax Credit.

The Child Tax Credit The White House

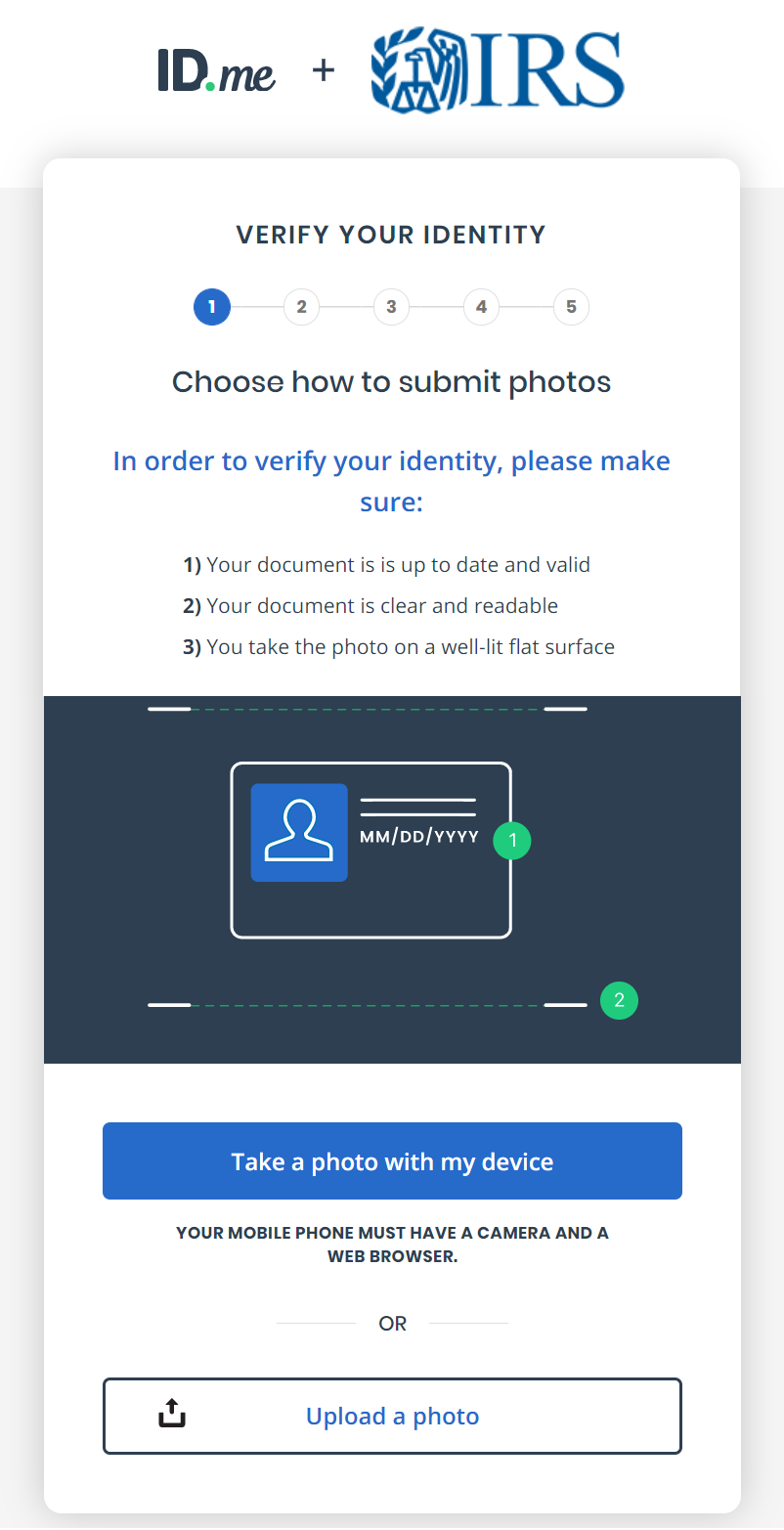

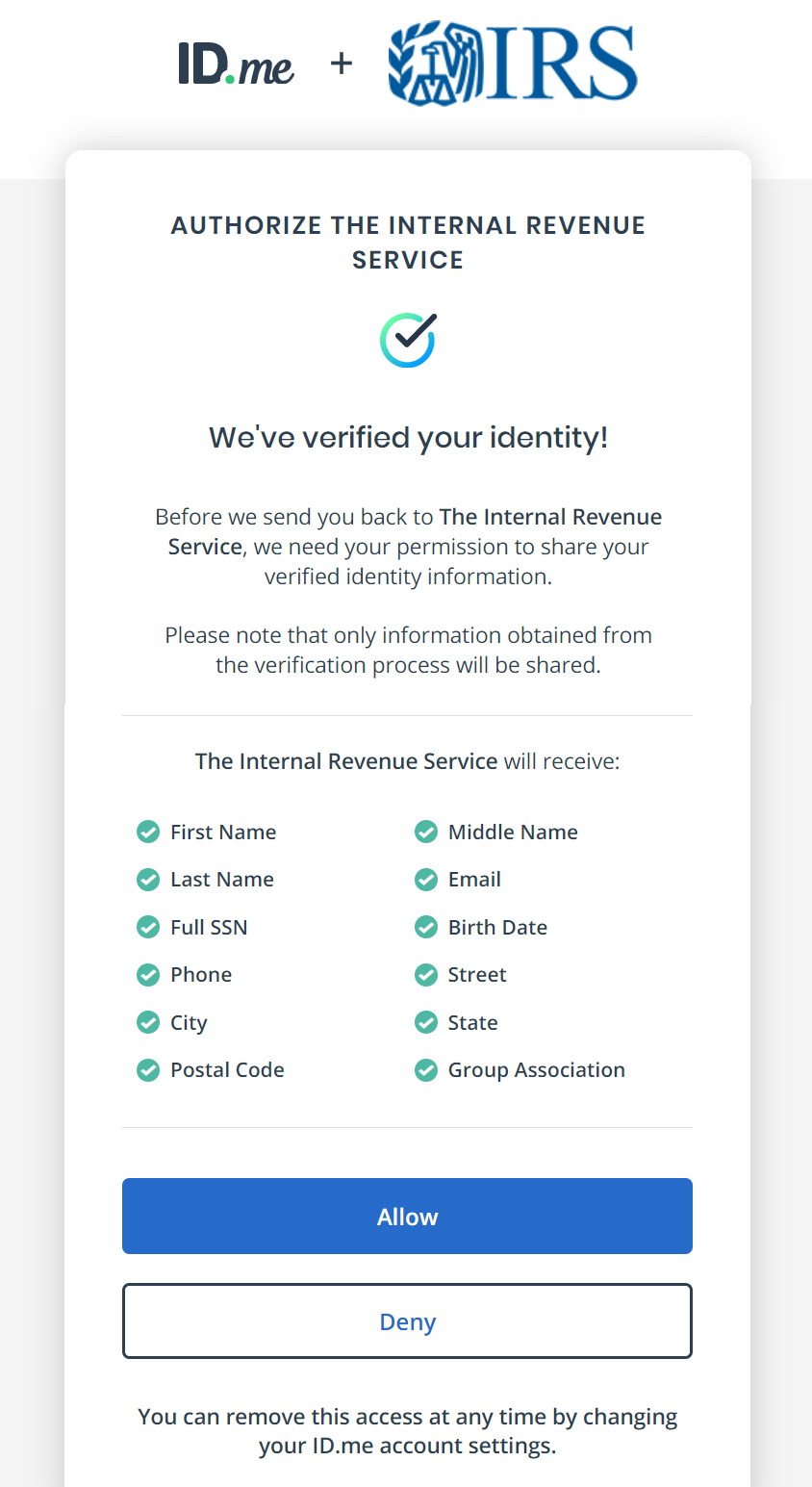

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

White House Unveils Updated Child Tax Credit Portal For Eligible Families

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Feds Relaunch Simplified Online Portal For Low Income Families To Claim Expanded Child Tax Credit Conduit Street

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Fearing Filing Season Chaos Irs Hits Pause On Web Tool For Child Tax Credit Politico

Kansas Action For Children Posts Facebook

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Time Is Running Out To Sign Up For Monthly Child Tax Credit Payments

Covid Related Tax Resources The Cpa Journal

Biden Administration Relaunches Simplified Online Portal For Low Income Families To Claim Their Expanded Child Tax Credit

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

2021 Child Tax Credit Advance Payments Claim Advctc

Irs Opens Child Tax Credit Portal How To Check If You Re Getting 300 Monthly Payments Syracuse Com

American Rescue Plan Enhanced Child Tax Credit Living Well In The Panhandle

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2022 Child Tax Rebate Check Deadline Is July 31 2022 Bloomfieldct